Decarbonising Europe: time to turn up the heat!

Olivier Delpon de Vaux

Decarbonising the heat sector is imperative to meeting carbon emissions reduction objectives across Europe. However, progress so far has been sluggish in most European countries. Sweden is an exception with 80% of its heat coming from locally sourced and abundant biomass. It sets an example for other European countries, where using local resources and heat networks can help decarbonise the heating sector, whilst also providing the characteristics that institutional investors look for in sustainable infrastructure investments. This is particularly exciting as new technology is emerging that will help ignite this transition.

The need to decarbonise heat

In the push to decarbonise Europe’s energy consumption, heating and cooling is clearly lagging the progress made in the electricity generation and transportation sectors. The heating and cooling sector represents 50% of Europe’s total energy consumption, yet today 75% of its primary energy comes from fossil fuels. Quite strikingly, we are still burning close to 500 million barrels of oil per year to heat our buildings, and a staggering 60% of Europe’s annual natural gas consumption is used for heating and cooling. As a result, this sector is responsible for about 40% of Europe’s CO2 emissions. Yet, when compared to power generation, it has attracted significantly less attention from either policy makers or institutional investors.

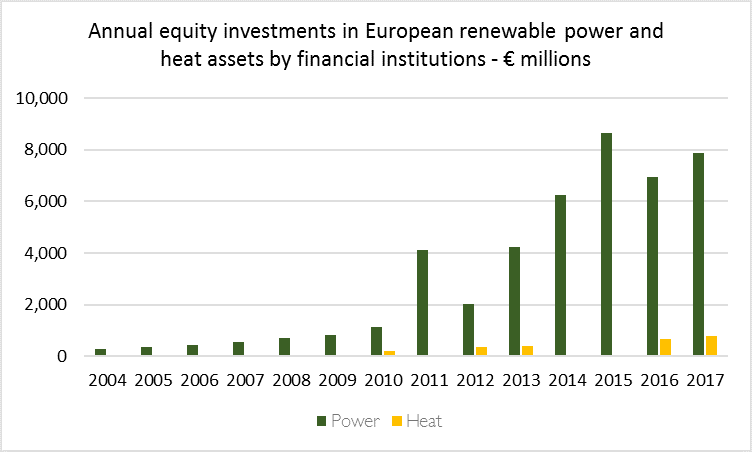

Institutional investors have become an essential driving force for financing electricity generation decarbonisation, with over €40 billions of equity invested in European renewable generation capacity over the last decade. Weakened by the financial crisis and often over-leveraged, utilities would never have had the necessary capital to shoulder these amounts alone. But it took time and effort to attract the deep pool of institutional capital.

When the EU set its 2020 target in 2007, renewable power was still a small subsector with unclear prospects. It was only when wind and solar became mainstream investable asset classes that momentum picked up and investment volumes scaled up significantly. In comparison, investments in heat are few and far in between. Most importantly, nobody – so far – has been talking much about it.

Source: Asper Investment Management research

In our view, the main reason for this limited focus is that heat is a significantly more difficult sector to decarbonise, which has led policymakers (and therefore investors) to focus elsewhere so far.

Why is it more difficult? First, there isn’t an obvious, cheap and renewable source of energy to produce heat, like wind or solar energy in the power sector. The potential for biomass in Europe outside of Scandinavia is very limited, and large-scale geothermal energy has, to date, been restricted to depths difficult to access. It is clear to us that the decarbonisation of heat can only be achieved through a variety of different technologies, adapted to the specific characteristics of each region. Therefore, the economies of scale seen in wind and solar will be harder to reach, and this will make the transition slower, and the investment opportunities less mainstream.

Second, institutional investors have been put off by the fragmentation, small scale and diversity of investment opportunities. Across Europe, more than 90% of heating and cooling is produced by smaller, decentralized heat production assets such as individual gas boilers, electric radiators or small-scale heat pumps. These assets tend to be owned by individuals or very small entities (e.g. an apartment block or an office building) and their cost falls significantly below the minimum threshold necessary to attract low cost of capital. The UK is a typical example of this with 26 million gas boilers installed in a country with 27 million households.

Finally, and importantly, heat is inherently more intrusive to the final consumer than power generation as it goes right into people’s homes, as opposed to being produced in remote areas and transported via transmission and distribution networks. As a result, it is much more personal to end users and consequently more vulnerable to local politics which tends to make change more difficult.

A turning point

Today we are seeing a few encouraging signs that the decarbonisation of heat is about to accelerate.

On the policy front, there is a clear shift beyond the historical focus on energy efficiency which, while important, will not decarbonise the heat sector alone. The EU proposed in 2016 a heating and cooling strategy which acknowledged the importance of decarbonising the sector and proposed to increase EU support in this effort. Certain individual countries have also set their own ambitious targets to meet CO2 reduction objectives. Specific examples include the “out of gas by 2050” policy recently adopted by the Netherlands (vs. 96% of Dutch households heated by gas today). Denmark aims to phase out fossil fuels entirely from all its energy sectors by 2050. Italy also published a 2030 strategic energy plan with a renewed push on clean heating and cooling.

But implementing policy will take time. New technology is needed, and here there is good news. For example, deep drilling technology imported from the oil and gas sector will allow us to tap into pools of geothermal heat that were previously uneconomical. With very limited opex and decreasing capex, this technology could open the doors of ultra-competitive “heat-as-a-service” solutions across new markets. Should it mature, geothermal heat could become the equivalent of wind and solar for heating our homes in some markets.

Digitalization and smart technologies are also starting to shake up the sector. The combination of software, intelligent sensors and enhanced data analytics can unlock virtual energy storage in buildings (i.e. using buildings as heat capacitors). With the european project D2Grids, the Dutch company Mijnwater is developing a predictive demand-based system that will also integrate with the electricity grid by storing excess power production in the form of heat, thus enabling greater penetration of renewable energy in the power sector at the same time

Just like in the renewable electricity sector 10 years ago, we are now seeing a convergence between policy and technology in the heat sector which we believe could precede another wave of investments.

District heating: an important catalyst for change

In this context, it is useful to draw lessons from a mature market which has largely decarbonizsd its heating sector 30 years ago: Sweden.

Sweden is arguably the most advanced sustainable heat market in Europe. The key to its success lies in the combination of abundant local and sustainable biomass resource, together with the wide use of district heating networks. Today 80% of Sweden’s heat demand is supplied by biomass and 50% of its citizens (almost everyone in urban environments) are connected to district heating. Also, one third of the equity invested in European heat assets by institutional investors in the last 5 years was invested in Sweden – a testimony of the maturity of the market

District heating is a much more efficient way of producing and distributing heat in densely populated areas than individual heat solutions. It also contributes to significantly improving local air quality. This is because instead of each consumption point possessing its own small boiler (usually around 30kW heat for an average household), the networks are supplied by larger multi-MW sources of heat that are on average over a third more efficient, even considering network losses. This advantage is likely to further improve with the widespread adoption of smart technologies.

Heat networks can also exploit local and often low/zero-cost heat sources that otherwise would not be used such as heat from industrial processes or energy from waste. These more complex fuels cannot be burned in a household boiler. Moreover, thanks to the increased decarbonisation of power and technological advances, we see high potential in the use of heat pumps in conjunction with ambient or stored heat from a variety of existing “heat sinks” such as geothermal wells or rivers to produce low-carbon heat that can be fed back into the networks. This is particularly good news for those countries which unlike Sweden are not blessed with abundant local biomass supplies.

Finally, with their long asset lives and stable margins, heat networks have many characteristics of an infrastructure asset, and as such they are far more likely to attract investment from financial institutions, as they did recently in Sweden.

Conclusion

It is clear to us that the decarbonisation of the heating sector across European markets is crucial to come anywhere near meeting European CO2 reduction targets. Today, we believe a wave of change has started in the sector. Whilst there is no silver bullet in fully decarbonising heat, we believe heat networks have a big role to play in catalyzing both change and investments. Combined with recent technological innovations, they allow each country to make the most of its own local low carbon heat sources. Importantly, they have the potential to attract investments from institutional investors who, just like in the power sector, will play an instrumental role in financing this transition. Today, we are starting to see the emergence of attractive investment opportunities across the sustainable heat space, be it in the development and construction of new heat networks, the refurbishment of ageing assets or the deployment of new technologies.

About Asper Investment Management

Asper is a specialist investment firm that focuses on private investments in sustainable real assets, including renewable power, heat and other clean infrastructure. It provides its services to medium to large institutional investors such as pension funds, insurance and funds-of-funds.

Through its RPP2 fund, Asper has been investing in sustainable heat since 2014. It established Vasa Värme, a district heating company in Sweden that has acquired, integrated and optimized 5 district heating plants to date, delivering over 170GWh of sustainable heat to communities across the country.